tax shield formula cpa

See If You Qualify For IRS Fresh Start Program. Tax Shield Deduction x Tax Rate.

Cca 1 Pptx Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes Cca Is Deducted Before Taxes And Acts As A Tax Shield Every Capital Course Hero

Accountants-Certified Public Bookkeeping Payroll Service 1 BBB Rating.

. Free Case Review Begin Online. Interest Tax Shield Interest Expense Tax. Sam Income Tax CPA.

Present value PV tax shield formula. The tax shield Johnson Industries Inc. ATA CPA Group LLC.

CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1. CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords. The maximum depreciation expense it can write off this year is 25000.

The formula for calculating a depreciation tax shield is easy. The tax rate for the company is 30. The effect of a tax shield can be determined using a formula.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900. CPA CFE REFERENCE SCHEDULE 2018 1.

151 Route 10 East Suite 204. Depreciation Applicable Tax Rate. Tsamutalis Company Llc.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. This is equivalent to the 800000. Sutaria CPA is an IRS registered tax preparer in Succasunna.

Thus if the tax rate is 21 and the business has 1000 of interest. It is important to have the depreciation numbers along with the income tax rate of. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

YEARS IN BUSINESS 732 572-7000. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. So the total tax shied or tax savings available to the. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above.

Investment Cost Marginal Rate of Income tax. 101 Cedar Lane Suite 103. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

As such the shield is 8000000 x 10 x 35 280000. The resulting figure is the tax savings due to depreciation. CPA Certified Public Accountant DBA.

Will receive as a result of a. CCA Tax Shield Notes - Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax rate 10 discount rate Year UCC CCA. 1653 State Route 27 Ste 201.

The applicable tax rate is 37. Calculating the tax shield can be simplified by using this formula. What is the formula for tax shield.

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new. Teaneck New Jersey - 07666. Calculate the Depreciation Tax Shield from the following formula.

There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. Chris E Tsamutalis is a certified public accountant. As such the shield is.

This is usually the deduction multiplied by the tax rate. You can also send us a message directly through the contact page of this website. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

Cash Flow Taxes And Project Evaluation Remember Income Versus Cashflow Pdf Free Download

Macrs Question Cma Study Group

Cca 1 Pptx Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes Cca Is Deducted Before Taxes And Acts As A Tax Shield Every Capital Course Hero

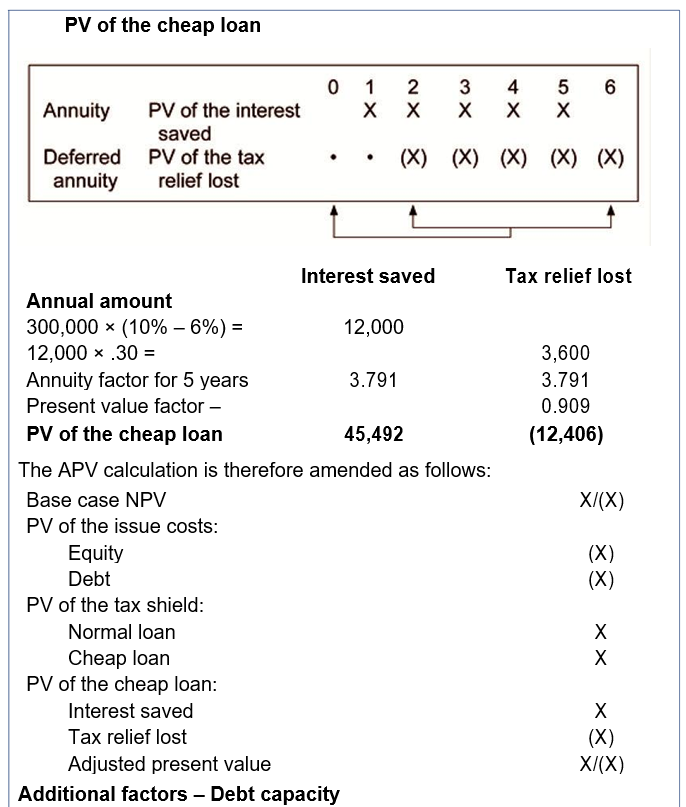

Risk Adjusted Wacc And Adjusted Present Value Masomo Msingi Publishers

Chapter 14 Capital Budgeting Decision Part B Other Approaches To Capital Budgeting Decisions Other Methods Of Making Capital Budgeting Decisions Include Ppt Download

What Are Common Adjustments To Gross Income Universal Cpa Review

Chapter 14 Capital Budgeting Decision Part B Other Approaches To Capital Budgeting Decisions Other Methods Of Making Capital Budgeting Decisions Include Ppt Download

Depreciation Tax Shield Definition And Formula Bookstime

Derivation Modigliani Miller S 2nd Proposition With Taxes

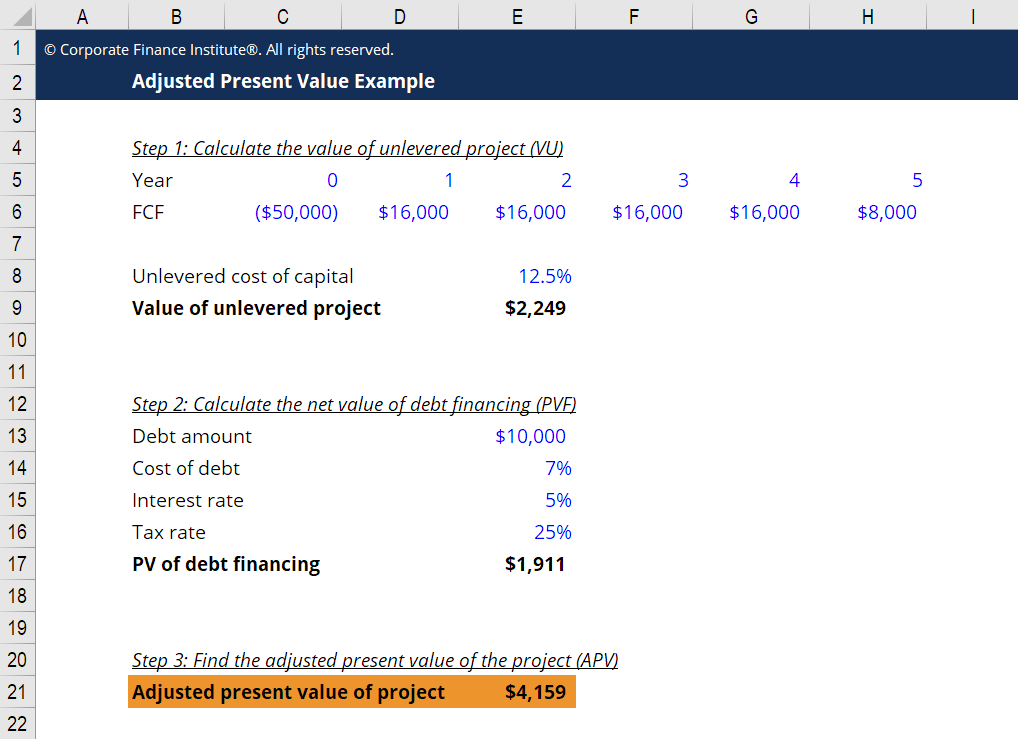

Adjusted Present Value Apv Definition Explanation Examples

Depreciation Tax Shield Definition And Formula Bookstime

How Is Agi Calculated In Tax Universal Cpa Review

Cash Flow Taxes And Project Evaluation Remember Income Versus Cashflow Pdf Free Download

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)