b&o tax states

Has physical presence nexus in Washington. Local business occupation BO tax rates Effective January 1 2022 City Phone Manufacturing rate Retail rate Services rate Wholesale rate Threshold Tax rates are provided for cities with general local BO taxes as of the date listed.

Double Duty How Startups And Small Businesses Could Be Hit Twice Under Seattle S New Income Tax Geekwire

This means you pay taxes on the total amount of revenue you pull in for your business whether you make a profit or not.

. In addition staffing businesses must collect retail sales tax and remit the collected tax to the state on all income subject to the retailing classification of the BO tax unless a specific statutory exemption applies. The nature of the activity determines the appropriate classification and tax rate. Heres what the BO tax looks like for your business.

Maycumbers legislation prioritizes small businesses serving rural and. Washingtons BO tax is calculated on gross income from activities. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Washington has a gross receipts tax. Washington unlike many other states does not have an income tax.

Local BO tax requirements are in addition to Washington State BO tax requirements Web. There is no tax on manufacturing business income. For example if you extract or manufacture goods for your own use you owe BO tax.

The tax amount is based on the value of the manufactured products or by-products. However because of the 420 per year small business BO tax credit nonprofit organizations with gross incomes below 28000 per year owe no BO tax. Are There Deductions for BO Tax.

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. You will receive a check for 50000 00484. Business owners who manufacture and sell products in Washington are subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

The state BO tax is a gross receipts tax. The BO tax for labor materials taxes or other costs of doing business. Washington Business Occupation Tax.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. It is measured on the value of products gross proceeds of sale or gross income of the business. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing.

Out-of-state taxpayers earning apportionable income attributable to Washington are required to apportion their revenue and report to Washington. Has more than 100000 in combined gross receipts sourced or attributed to Washington. The state BO tax is a gross receipts tax.

Washington unlike many other states does not have an income tax. Constitution because it discriminates against out-of. Washingtons BO tax is calculated on the gross income from activities.

In order to take advantage of those dollars the state can offer a small BO tax credit which encourages donations to the 29 CDFIs operating in Washington state. However you may be entitled to the. The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW.

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. It is measured on the value of products gross proceeds of sale or gross income of the business.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. A 484 percent or 004 increase. While the claim that we dont have an income tax is technically true you pay the BO tax on your gross income.

However your business may qualify for certain exemptions deductions or credits. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. The BO offers very few deductions and those allowable are often within narrowly defined industry sectors.

So that means you only get to deduct returns never collected money and out of state sales. Most nonprofit organizations provide services and therefore pay BO tax at the services rate of 15 percent. 1 2020 a business must register to report BO tax and collectsubmit applicable sales tax if the business meets any of the following thresholds in the current or prior year.

225 215-0052 Toll Free. A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US. Provide an exemption for state taxes.

Washington State BO tax is based on the gross income from business activities. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. If a city is not listed they have not reported to AWC that they have a local BO tax.

Business and Occupation Tax. Additional BO tax imposed on financial institutions. If you run a 1000000 manufacturing or wholesaling firm you will owe 484 or 4840 in business and occupation taxes.

You pretty much pay BO on all your net in-state revenue. In-state taxpayers that earn income from apportionable business activities performed for customers located inside and outside of Washington may apportion such revenue to Washington for BO tax purposes. BO also does not consider income or loss offers no deduction for cost of.

Valley Of The Shadow Amazing Website All About Shenandoah Valley Before During After Civil War Unit Teaching American History High School History Teacher

When Are Business Occupation B O Taxes Due

Retro Baltimore The Sun Front Page How To Get Retro

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

Westward Movement Resource Box Gr 4 5 In 2021 Westward Movement Lakeshore Learning Social Studies Maps

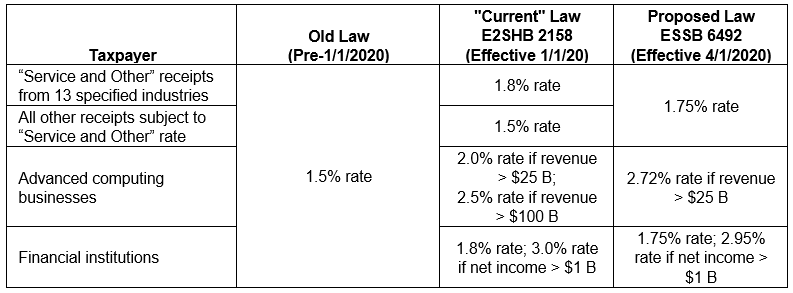

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Why Our B O Tax Is Unfair R Seattlewa

Netherlands Both Urban And Agricultural Number Two Facts Fun Facts

First Produciton 747 100 Nose Section Is Mated With Wing Section Boeing Aircraft Aircraft Jet Engine

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

B Amp O Tax Guide City Of Bellevue

A Guide To Business And Occupation Tax City Of Bellingham Wa

Pin By H H On Books West Virginia Virginia True Crime

Photo N747bc Cn 25879 Boeing Company Boeing 747 4j6 Lcf By Brock L In 2021 Boeing Dreamlifter Boeing 747 Airplane Photography

747 8f Rollout Of Everett Factory Boeing Aviation Blog Aviation

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Train